While most often associated with gambling, the phrase ” if you don’t play you can’t win” is what I say to myself every time I send off a submission for review, not because it is a gamble but because of the truth of the statement. If you are one of the many who dream of having your work traditionally published, displayed in a gallery, or publicly recognized, you have to submit it for consideration by other people.

Is is easy? Yes, it is easy to hit send, but it can be incredibly stressful to assemble a submission package, book proposal, portfolio, manuscript, short story, or any other creative project. Some people get so overwhelmed they never submit anything. It is an act of confidence for any creative person to submit their work for review. As Erykah Badu says ” I’m an artist and I’m sensitive about my sh*t…” and Ms. Badu is so right. I have yet to meet a creative person who is not personally invested in their work.

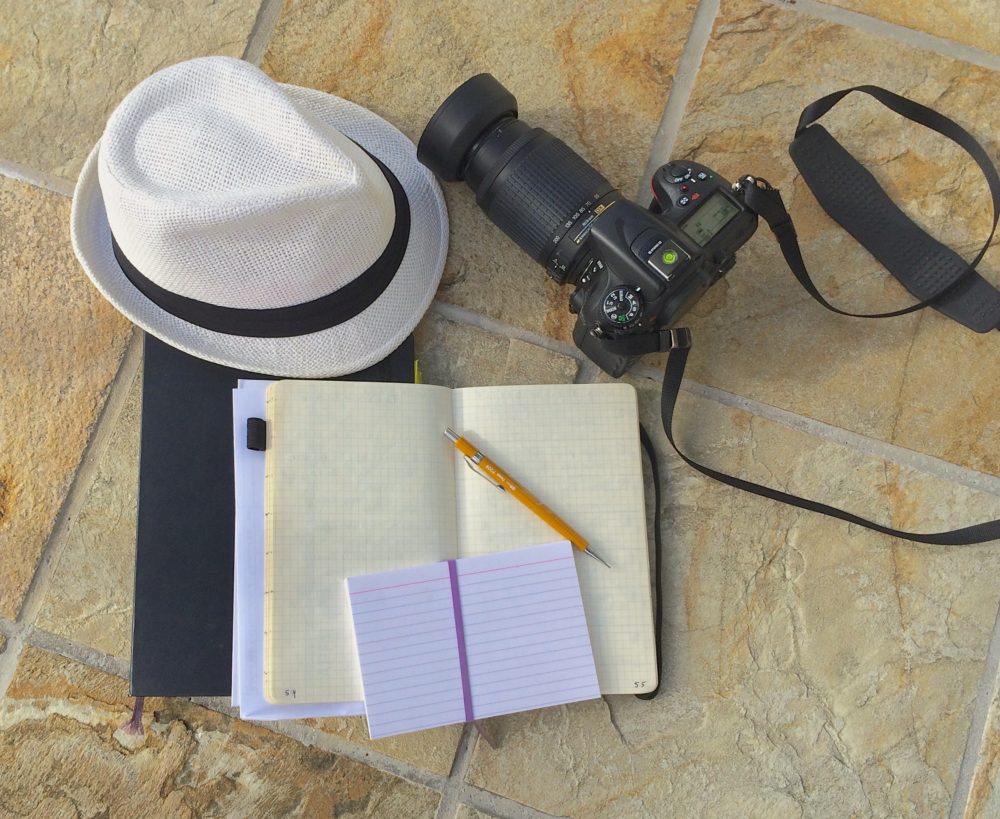

Just reading submission guidelines can be overwhelming and knowing that making a mistake can get your submission rejected before it is ever reviewed can create so much stress that many individuals give up. A large percentage of creative people have attention issues and struggle with details. Here are ten organizational tips to make the submission process less stressful.

4. Date all drafts, or versions of your project. This prevents you from sending the wrong version of the file when it is time to send in the final version.5. Set reminders for key dates, these can be written reminders or electronic reminders.

6. Have another person, preferably someone who is detail oriented review your submission before you send it. Give them the guidelines and ask them to review your submission to see if you have everything required. Buy this person a beverage of their choice for helping you.

7. Be realistic and take your time. This is very difficult for many creative people, and particularly difficult for people with ADD/ADHD. Creating is fun, paying attention to details not so much, but if your brilliant work is never reviewed because you did not follow the submission guidelines you are defeating yourself.

8. Remember that as hard as it is to hit “send” or mail that package, it is the only way it is going to get reviewed: If you don’t play you can’t win.

9. Expect to have some anxiety after you submit your work. See Ms. Badu’s quote above, then get to work on your next project.

10. Celebrate. You have done something that many people dream of and never ever do. Celebrate your determination, celebrate your work, celebrate no matter what.

So hit the send button, drop off the portfolio, submit your creative work, jump in with both feet.